HR Myth #2: Your Tuition Assistance Program is a Benefit

Most companies cap tuition assistance at $5250, which is the amount they can deduct from their taxes so it doesn’t cost them anything. In busting this myth we ask the question: When is a benefit not a benefit? When it is nearly impossible to use, and when it can be rescinded.

How far does $2500 go when:

- The average total annual cost to attend a community in the U.S. college is $10,300.

- The average cost of a private two-year trade school is $25,000

Even if you look outside degree programs, it costs $500-24,000 to learn a new skill.

Most companies cap tuition assistance at $5250, which is the amount they can deduct from their taxes so it doesn’t cost them anything. Whether is it $2,500 or double that, making up the difference on minimum wage is tough.

Or let’s take another well-known tech company, which announced that it will pay 95 percent of tuition for employees. Up to $3000 per year, and $12,000 total. The average wage for hourly employees is $13-$17 per hour.

Strings Attached

When is a benefit not a benefit? When it is nearly impossible to use, and when it can be rescinded.

“No doubt, you’ve heard about the trend of employers paying for college now,” said Peter Capelli, a management professor at Wharton. “Like many contemporary stories about business, it’s not true: The reality is that employer support for students attending college has been declining for some time.”

And let’s look at some more numbers:

- It takes an average of four years to get a two-year degree

- The shelf life of skills has dropped to 2-3 years

Employees may end up paying a lot for skills that might not be relevant by the time they graduate.

Debt is not a Benefit

“In the era of shareholder maximization and business PR,” said Capelli, “there are a lot of strings attached to these programs that make them less generous than they appear.”

Those strings come in the form of:

- Graduating.

- Maintaining a minimum GPA

- Qualifying job performance

- Staying at the company for a set amount of time after graduation

Some programs require employees to pay back the amount given if they drop out of compliance.

Debt is not a benefit.

All of this explains why just 2-5 percent of eligible employees use tuition assistance programs offered by their companies, and why the global skills gap between the skills employers need and the skills that they have is getting wider.

Inherent Bias

Traditional employer tuition assistance programs are also inherently biased towards populations with:

- Discretionary income

- Free evenings and weekends

- Transportation

- Childcare

We Can do Better

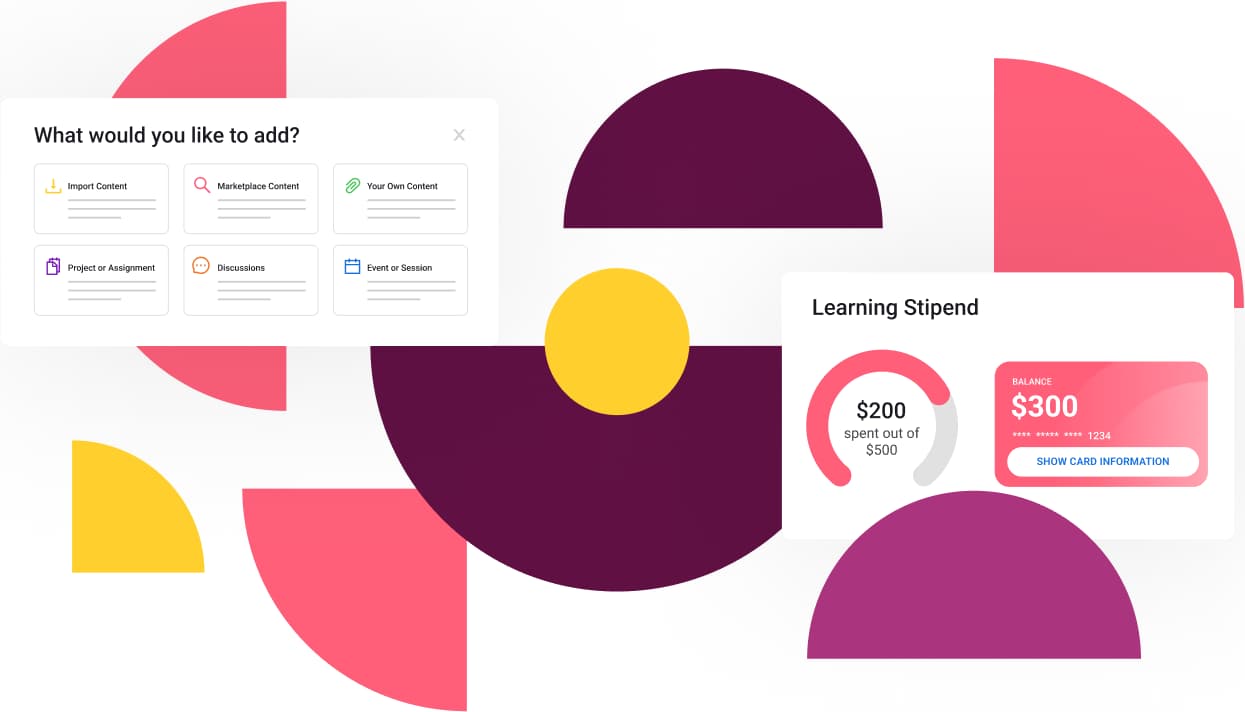

We can do better. To bridge the skills gap and to keep skills current we need an end-to-end talent infrastructure that continually upskills all populations in real-time, providing the time, paying the costs to learn immediately applicable skills.

“The solution to the skills gap often lies within your current workforce,” said workplace diversity advocate Nabila Salem. “Upskilling not only helps address the skills gap in technology, but it also presents an opportunity for the industry to make real inroads when it comes to improving diversity and inclusion.”

Written By: Deeps Ramanathan, CMO, Learn In

About Learn In

Learn In is the first talent-building platform designed for companies to solve every barrier that stands in the way of creating tomorrow’s workforce. Organizations use Learn In to identify talent-building goals, design skill-based programs, learn together in cohorts with coaches, and access flexible financing, delivering measurable outcomes for every dollar spent on upskilling the workforce. Co-founded by the founders of Degreed, Learn In is backed by leading edtech & future-of-work investors, including GSV, Album, Firework Ventures, and Village Global, and has been covered in CNBC, USA Today, EdTechReview, EdSurge, and Techcrunch.

For more insights, follow us on LinkedIn, or subscribe to our newsletter to stay in touch.